The Impact of Fees: Rethinking Local Revenues for More Multifamily Housing

Across California, local jurisdictions require home builders to pay development impact fees as a condition of approving new housing construction. The use of these fees, which vary in purpose and size, expanded widely in response to the loss of property tax revenues that followed the passage of Proposition 13 in 1978. Today, nearly all California localities charge some form of impact fee.

Impact fees, however, are not only used to generate revenue but can be a tool to stymie growth. This is an area of public policy that is overdue for reform. The United States Supreme Court ruled in April 2024 that California courts were reviewing development impact fee schedules too leniently to meet constitutional standards. The time is ripe for change to support multifamily housing growth.

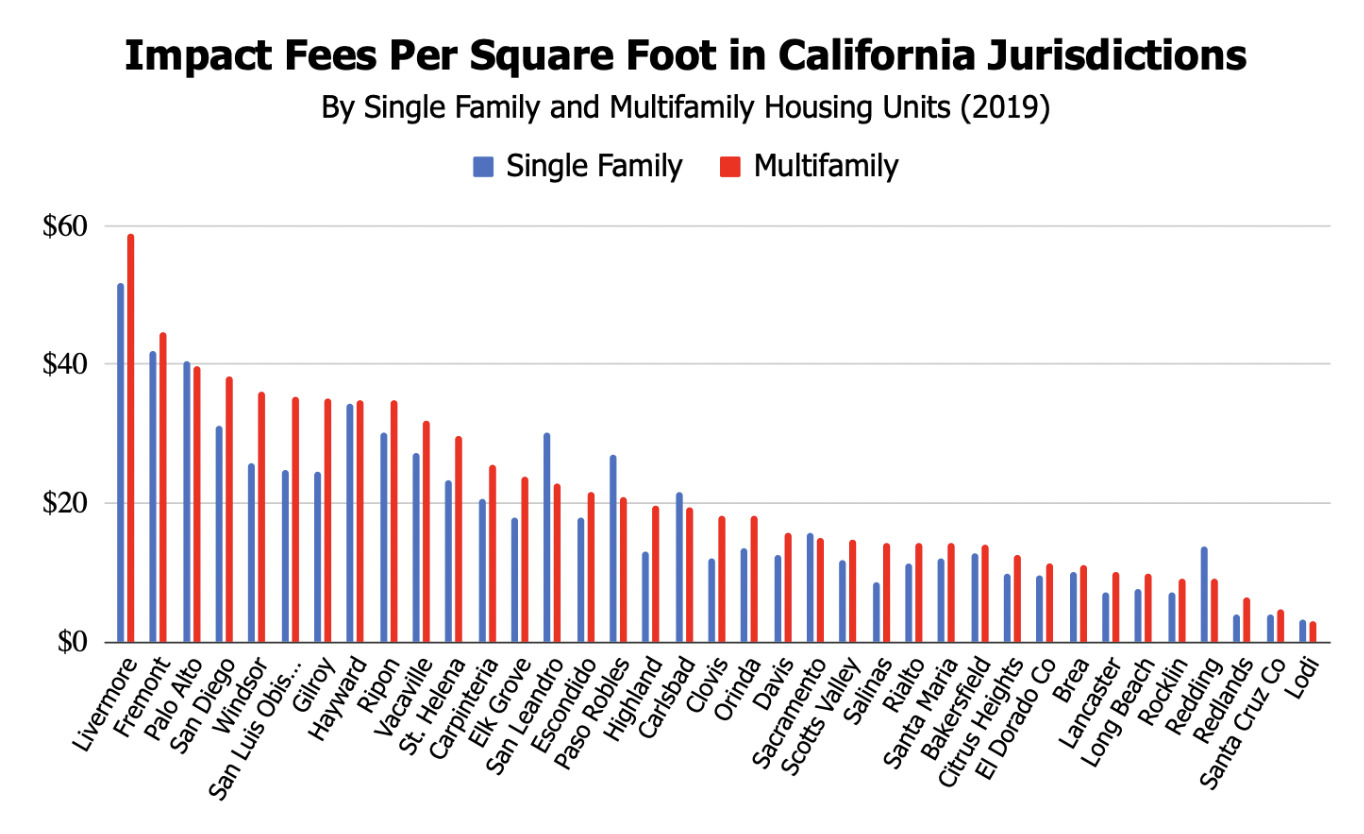

In some instances, local governments use impact fees to assign costs of infrastructure maintenance to future residents, while allowing the increased property values of functioning infrastructure to accrue to current residents. In other cases, jurisdictions charge higher impact fees for multifamily homes than they do for single-unit homes on a per-square-foot basis, even though multifamily homes reduce infrastructure impact. In the worst cases, cities adjust impact fees upward until new housing construction is no longer feasible at all.

What are the various political and fiscal incentives that underpin development impact fees in California? How might impact fees be reformed to make them fairer and more predictable? Are impact fees the best tool for the job of generating necessary government revenues? And what might alternative revenue sources to impact fees look like?

Key findings of this study include:

- Property tax revenue declined by 53 percent immediately after Proposition 13 passed, falling from 58 percent of local revenue in 1972 to just 36 percent by 2012.

- Impact fees only account for 2.6% of the average California cities’ reported revenue. However, reliance on revenue from impact fees varies greatly across jurisdictions, from as high as 16% to less than 0.5%.

- The average impact fee on a multifamily unit in California is $21,703, nearly triple the national average of $8,034. Similarly, California’s average single-family unit fee of $37,471 is triple the national average of $13,627.

- Developers transfer impact fee costs to homeowners and renters, increasing multifamily unit costs up to $60,000 and single-family unit costs up to $100,000.

- Most jurisdictions charge higher fees per square foot on multifamily units compared to single-family homes, which disincentivizes multifamily housing construction. In some cases, higher fees for multifamily homes result from overt efforts to block the construction of new apartment buildings.

- Many cities that had the lowest increases in impact fees had the greatest increases in multifamily housing. Conversely, cities with the greatest increases in multifamily impact fees experienced the lowest growth in multifamily housing.

Remedies: Shift Revenue to Broad-Based Bonds and Fee Fairness

We review current policies, like AB 602, meant to reform impact fees through increased disclosures and guidance on how to properly calculate fees. Most jurisdictions are not complying with AB 602 mandates to disclose fee schedules, fiscal impact studies meant to justify those fee schedules, or actual fees charged to new development. In addition, we evaluate a sample of nexus studies – fiscal impact reports meant to justify impact fees. Most of these studies do not comply with AB 602 mandates and contain fees that likely overcharge new residents for their impacts on public capital. Overall, it appears current policies contain inadequate enforcement mechanisms to ensure compliance.

Following this review of current policy, we assess three policy options aimed at removing barriers to multifamily housing by reducing local governments’ reliance on impact fees:

- eliminating impact fees altogether;

- reducing barriers to challenging unjustified fees in court; and

- capping impact fees.

Policies such as ACA 1 – which would expand jurisdictions’ capacity to raise revenue and spread the fiscal responsibility of paying for publicly-provided goods across the entire community – would go a long way toward solving local fiscal challenges while simultaneously minimizing per capita costs. Californians are set to vote on ACA 1 in November 2024.

Capping fees on a per-square-foot basis would also help streamline the administrative process, provide flexibility in the fee assessment timing, and incentivize smaller, more affordable units.

Given these findings, we recommend the following:

- Stronger enforcement of provisions in state law that require fees to be calculated on a per-square-foot basis, regardless of housing typology.

- Stronger enforcement of provisions in state law that require consistency and transparency in how fees are determined, as well as streamlined sequencing.

- Increasing private enforcement to discourage unjustified fees by providing an award of attorney’s fees and costs, as well as punitive damages, to successful plaintiff home builders.

- A cap on impact fees, on a per-square-foot basis, alongside efforts to replace lost municipal revenue streams, such as ACA 1.

We strive to be constantly improving our work. Notice something that seems off? Have an idea for how we can expand on the work? We want to hear from you—submit feedback here.