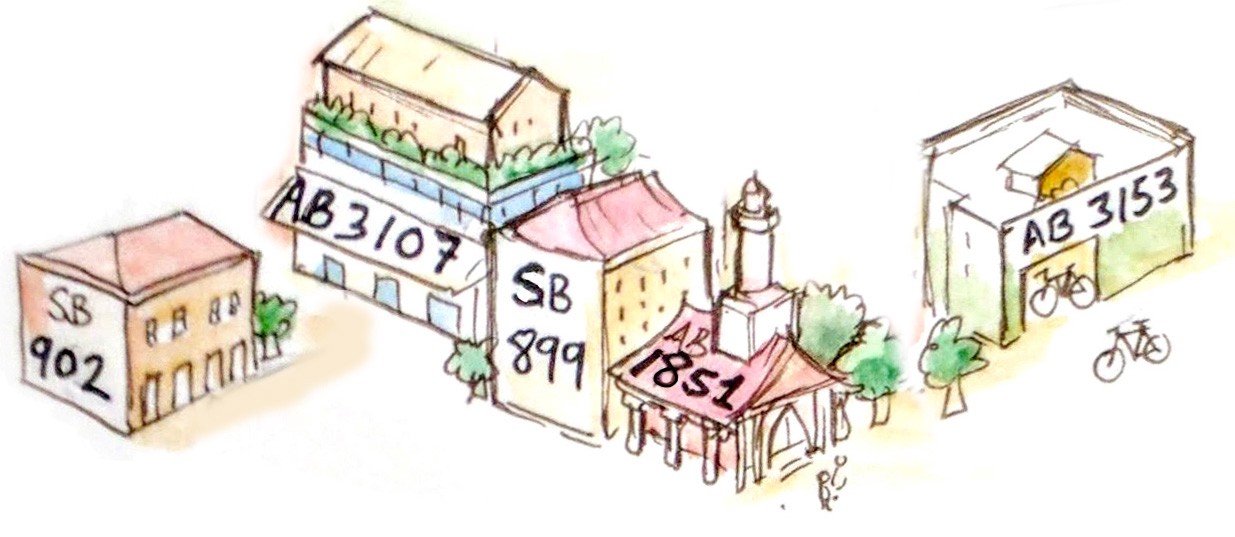

2020 California Housing Legislation Highlights

Latest Update: March 17, 2020

In 2019, to tackle the housing crisis, California legislators introduced dozens of housing bills, many of which passed. This year, there are even more bills proposed.

Note: there are also additional emergency bills right now to get people housed and protect tenants and homeowners during the virus outbreak, but these are moving and changing very quickly. This graphic focuses on regular bills.

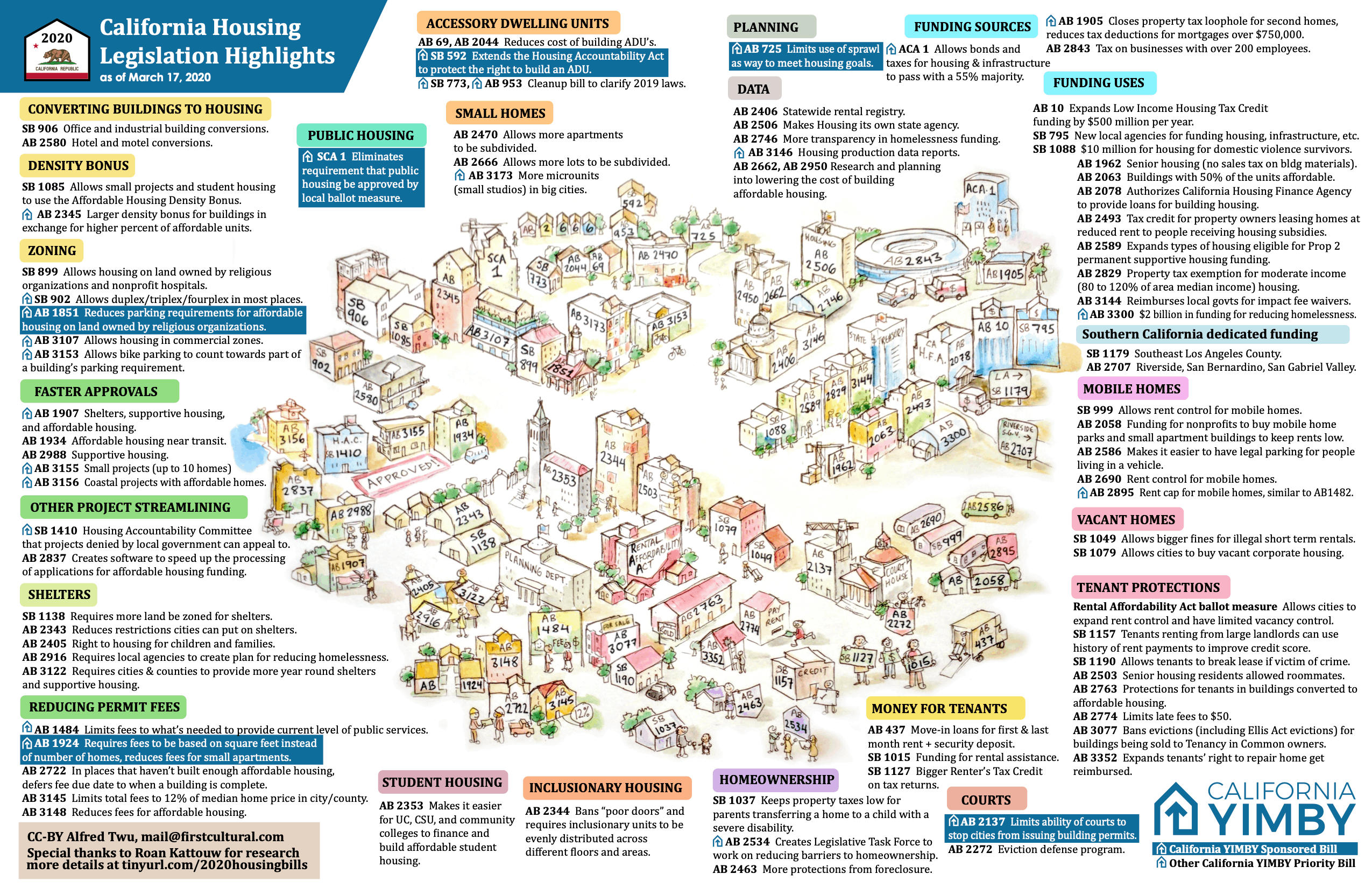

Converting Buildings to Housing

SB-906 Housing: joint living and work quarters and occupied substandard buildings or units. (Skinner)

This bill makes it easier to legally use old industrial and commercial buildings into group housing, and creates a path for substandard buildings to be brought up to code.

AB-2580 Conversion of motels and hotels: streamlining. (Eggman)

Simplifies the process of turning a hotel, motel, or commercial building into long term housing.

Density Bonus

California’s Density Bonus program allows new buildings to be bigger, in exchange for providing affordable housing. Two 2020 bills expand this program.

SB-1085 Density Bonus Law: qualifications for incentives or concessions: student housing for lower income students: moderate-income persons and families: local government constraints. (Skinner)

Currently, a project needs to have at least 5 homes before it can use the Density Bonus. SB1085 eliminates this requirement, allowing small buildings such as duplexes get an extra unit in exchange for some affordable housing. It also creates more options for moderate income housing (where rents are affordable to people making 80–120% of area median income) and student housing to use the Density Bonus.

AB-2345 Planning and zoning: density bonuses: affordable housing. (Gonzalez)

Currently, the maximum density bonus for a mixed income development is 35%, which can be achieved if a building is 20% low income housing. AB2345 increases the bonus scale, up to 50% for buildings that are 33% low income housing.

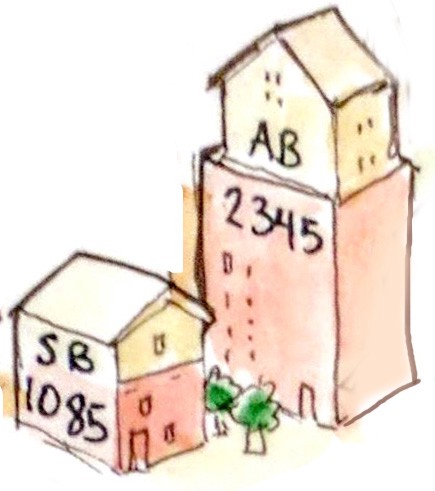

Zoning

SB-899 Planning and zoning: housing development: nonprofit hospitals or religious institutions. (Wiener)

Makes it easier for nonprofit hospitals and religious institutions to build low income housing.

SB-902 Planning and zoning: neighborhood multifamily project: use by right: density. (Wiener)

Allows the following statewide, except in very high fire hazard zones.

In unincorporated areas and cities under 10,000 people: Two homes per lot.

In cities of 10,000–50,000 people: Three homes per lot.

In cities of over 50,000 people: Four homes per lot.

Also makes it easier for cities to rezone land for up to 10 homes per lot, if near transit, near jobs, or on a urban infill site.

TBD: Transit-oriented development bill.

A bill focusing on homes near transit is to be announced.

AB-1851 Faith-based organization affiliated housing development projects: parking requirements. (Wicks)

Also known as the “Yes in God’s Backyard” bill, AB1851 would allow more religious organizations to build homes on their parking lots.

AB-3107 Planning and zoning: general plan: housing development. (Bloom)

Currently, many cities have yuge areas of commercial zoning where office buildings and stores are OK, but housing isn’t. AB3107 would allow homes in these areas if 20% of them are affordable.

AB-3153 Parking and zoning: parking credits. (Robert Rivas)

Allows bike parking and carshare spaces to count towards parking requirements. Two bike spaces would count as one car space. Each carshare space would count as two regular car spaces. Up to 30% of the parking requirement could be met with bike spaces, and an additional 30% with carshare spaces.

Public Housing

SCA-1 Public housing projects. (Allen, Wiener)

In 1950, California voters passed a ballot measure that added Article 34 to the state constitution. Article 34 prevents cities from building low rent housing projects unless a local ballot measure is passed.

Senate Constitutional Amendment (SCA) 1 would begin the process of repealing Article 34. If SCA-1 passes, California voters will get a chance to vote on a ballot measure to repeal Article 34.

Accessory Dwelling Units (ADUs)

Also known as in-law units, granny flats, casitas, ADUs are small apartments added to a property that already has a house on it. They can take the form of basement apartments, backyard cottages, or additions.

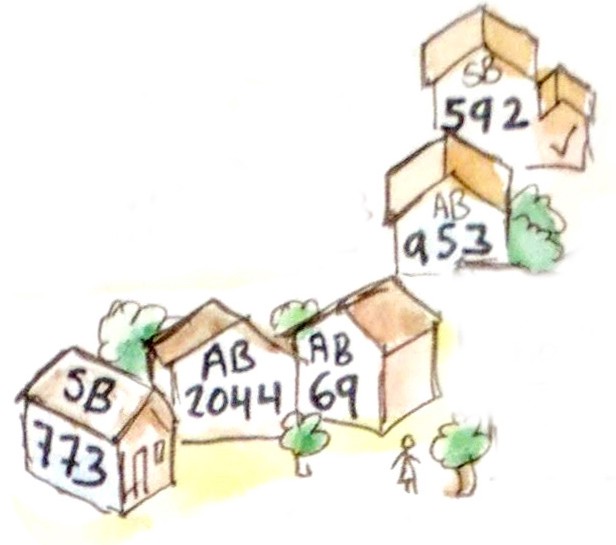

AB-69 Land use: accessory dwelling units. (Ting, Quirk-Silva)

Would create a California Small Home Building Code, making it cheaper to build houses and cottages that are under 800 square feet (about the size of a modest two-bedroom house).

SB-592 Housing development: Housing Accountability Act: permit streamlining. (Wiener)

The Housing Accountability Act (HAA) is existing law that requires cities to approve new housing that meets zoning standards. SB-592 would clarify that the HAA also applies to adding new ADUs to a property.

SB-773 Land use: accessory dwelling units. (Skinner) and AB-953Land use: accessory dwelling units. (Ting, Bloom)

A pair of “cleanup bills” that make minor edits to clarify the ADU bills passed in 2019.

AB-2044 Building standards: photovoltaic requirements: accessory dwelling units. (Voepel)

Existing law requires most new buildings in California to have solar panels. However, ADUs are often single-story buildings right next to and in the shadow of taller buildings, and even ones that have direct sun have roofs too small to hold a cost-effective system. AB2044 would exempt ADUs from the solar requirement.

Smol Homes

AB-2470 Splitting multifamily dwelling units: streamlined ministerial approval. (Kamlager)

Allows large apartments and condos to be more easily divided into smaller homes. Streamlines the approval process, and waives parking requirements, density limits, and minimum unit sizes.

AB-2666 Starter Home Revitalization Act of 2020. (Boerner Horvath)

Allows land that is zoned for more than one home to be subdivided into small lots that can be sold separately. Size of homes would be limited to 1,200 square feet.

AB-3173 Microunit buildings. (Bloom)

In cities of over 400,000 people, allows microunit housing (small studio apartments that share common kitchens, also known as residential hotels or co-living) to have unlimited density. Number of units limited by existing zoning’s height and yard limits, with yard requirements reduced to 5 feet, and height limits increased by 1 story. No parking required.

Faster Approvals

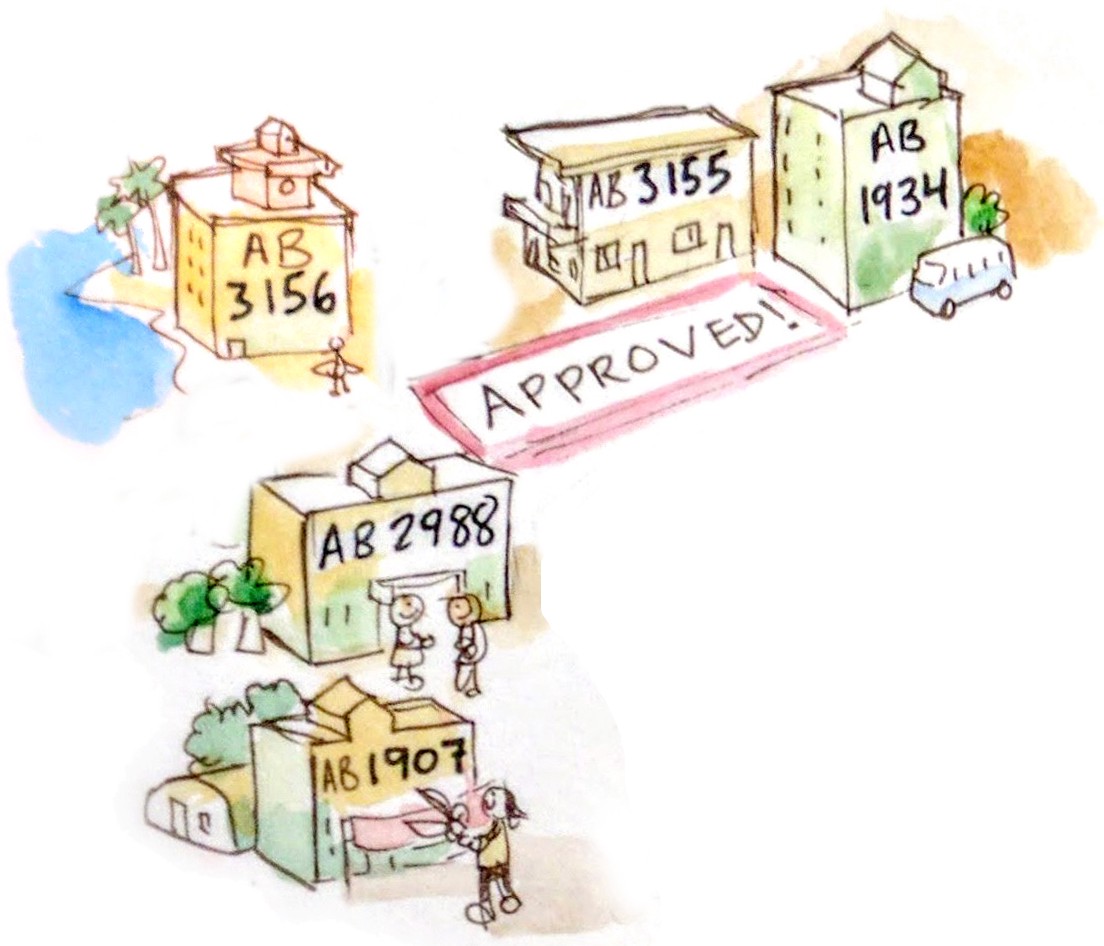

AB-1907 California Environmental Quality Act: emergency shelters: supportive and affordable housing: exemption. (Santiago, Gipson, Quirk-Silva)

In California, the California Environmental Quality Act (CEQA) requires major construction projects to go through a lengthy review and comment process, including an Environmental Impact Report that identifies possible impacts , mitigation strategies, and alternatives. AB1907 would exempt emergency shelters, supportive housing, and affordable housing from CEQA.

AB-1934 Planning and zoning: affordable housing: streamlined, ministerial approval process. (Voepel)

Requires city planning staff to approve affordable housing within 30 days of receiving the plans, if the project meets zoning requirements.

AB-2988 Planning and zoning: supportive housing: number of units: emergency shelter zones. (Chu, Chiu)

Allows supportive housing to be built anywhere that emergency shelters are allowed. Supportive housing is subsidized housing that also has on-site social and health services for the residents.

AB-3155 Subdivision Map Act: small lot subdivisions. (Robert Rivas)

Allows land zoned for more than one home to be divided into small lots, with half the homes on those lots reserved for first-time homebuyers for 90 days. Also allows apartment buildings with up to 10 homes to be approved by city planning staff instead of having to go through public hearings in front of a planning commission or city council.

AB-3156 Coastal resources: coastal development permits: affordable housing. (Robert Rivas)

Projects near the coast in California are required to get approval from the California Coastal Commission. AB3156 would speed up the approval process for projects containing affordable housing.

Other Project Streamlining

SB-1410 Housing: local development decisions: appeals. (Lena Gonzalez)

Establishes a Housing Accountability Committee within the Housing and Community Development Department. Projects denied by a city and projects where the city adds requirements that make it infeasible could be appealed to the HAC, which would have the power to override the local government and approve the project.

AB-2837 UNITY Act: affordable housing software. (Quirk-Silva)

Creates a software platform that affordable housing organizations can use as a one-stop-shop for applying for multiple types of funding, as well as document , construction, and property management.

Shelters

SB-1138 Housing element: emergency shelters: rezoning of sites. (Wiener)

Reduces the number of regulations and standards that cities can put on new shelters to objective written standards, also allows shelters in nonresidential areas close to services and transportation.

AB-2343 Local planning: housing element: emergency shelters. (Eggman)

Currently, cities can require that emergency shelters meet various standards such as maximum number of beds or persons permitted to be served nightly by the facility, sufficient parking to accommodate all staff working in the emergency shelter, the size and location of client intake areas, the provision of onsite management, the proximity to other shelters, the length of stay, lighting, and security during operating hours. AB2343 would limit the required standards to management and security during operating hours.

AB-2405 Housing: children and families. (Burke, Chiu, Gonzalez)

This bill creates a Right to Housing for children and families. Based on New York City’s policy, this right would be backed by rent assistance, eviction defense, as well as emergency and permanent housing.

AB-2916 Homelessness plan of action. (Bloom)

Requires cities to create a Plan of Action in 2022 and every 4 years after, that includes identifying surplus land for homeless shelters, assisted living units, and affordable housing.

AB-3122 Housing element: emergency shelters, temporary housing, and supportive housing. (Santiago)

Requires cities and counties to identify sites for emergency shelters, temporary housing, and supportive housing; allows permanent supportive housing to count towards number of emergency shelter beds needed, and also requires at least two year-round emergency shelters.

Fees

Cities charge fees to cover the cost of building new schools and other infrastructure. However, some cities set the fees much higher than others, with fees of around $100,000 per home — far more than needed to provide services, and with a result of discouraging homebuilding.

AB-1484 Mitigation Fee Act: housing developments. (Grayson)

AB1484 started last year as a bill to require a city’s development fees be published online. It’s since been amended to be a bill that limits fees to the amount of money that is required to give the new homes the same level of city services as the rest of the city.

AB-1924 Housing development: fees. (Grayson)

Currently, many cities have a flat rate impact fee, with a studio apartment paying the same fee as a mansion or luxury penthouse. AB1924 would require fees be proportional to the number of square feet in a home.

AB-2722 Development fees and charges: deferral. (McCarty)

Currently, some cities require development impact fees to be paid when the building permit is issued, prior to starting construction. In cities that haven’t built enough low income or moderate income housing, AB2722 would move the fee payment deadline to when the building is completed.

AB-3145 Local government: housing development projects: fees and exactions cap. (Grayson)

Limits impact fees on new housing to 12% of the median home price in a city or county.

AB-3148 Planning and zoning: density bonuses: affordable housing: fee reductions. (Chiu)

Reduces the fees on affordable units located within a mixed-income housing development.

Student Housing

AB-2353 Public postsecondary education: affordable housing for students.

This bill would make it easier for the University of California, the California State University, and the California Community Colleges to finance and build housing for low income students.

Inclusionary Housing

AB-2344 Housing: affordable and market rate units. (Gonzalez)

This bill would require that affordable housing units in a mixed-use project are distributed throughout the building, and not limited to a certain floor or side of the building. It would also ban “poor doors”, requiring all residents to have access to all entrances and common areas in the building.

Homeowner Protections

SB-1037 Property taxation: base year value transfers. (Archuleta, Jones)

1978’s Proposition 13 limits the amount that property taxes can go up to 2% a year, even if the property value increases by a greater amount. When a property is sold or transferred, it is re-assessed and property taxes can increase dramatically. SB1037 would allow property to be sold/transferred to a parent or legal guardian of a severely and permanently disabled child that is living with the child, without being re-assesed for higher taxes. Since it modifies a previous state proposition, if passed by the state legislature, it would also have to go to the ballot for voter approval.

AB-2463 Enforcement of money judgments: execution: homestead. (Wicks)

Currently, if a homeowner owes money and is unable to pay, the lender can force a sale of their home to pay the debt. AB2463 would ban lenders of unsecured consumer debt (such as medical debt, credit card debt, etc) from forcing a sale of someone’s home.

AB-2534 Legislative Task Force on the California Master Plan on Home Ownership. (Quirk-Silva)

Creates a Legislative Task Force on the California Master Plan on Home Ownership. It would be made up of 5 assembly members, 5 state senators, and a representative of a housing or home ownership advocacy organization. They would be tasked with delivering a report on how to reduce barriers to homeownership.

Money for Tenants / Rent Assistance

AB-437 Move-In Loan Program. (Wood)

Some Californians can afford rent, but don’t have the money saved up for security deposit, first/last month rent, etc. AB437 provides move-in loans to pay for that. This bill passed the Assembly last year and is now in the State Senate.

SB-1015 Keep Californians Housed Assistance Fund. (Skinner)

Provides rent assistance and money for moving costs for people experiencing or at risk of homelessness.

SB-1127 Taxation: renters’ credit. (Glazer)

Homeowners get the mortgage interest tax deduction, which can be worth thousands of dollars of savings on their income taxes. In contrast, renters get a $60 tax credit if individual, or $120 if a household of 2 or more. This hasn’t changed since 1979, and has not been increased to account for inflation. SB1127 seeks to increase the renters’ credit.

Courts

AB-2137 Planning and Zoning Law: court orders: housing development projects. (Wicks)

Currently, courts can stop cities from issuing new building permits if their general plan is successfully challenged in court. AB2137 would exempt housing construction from a court ordered suspension of issuing building permits.

AB-2272 Real Property: Eviction Defense. (Gabriel, Chiu)

This bill would create a statewide program for eviction defense. Some cities, such as San Francisco, already have local programs. Such programs guarantee tenants facing eviction a right to a lawyer, which evens the playing field when they face a landlord in court.

Tenant Protections

Rental Affordability Act (Ballot Measure / Proposition)

This ballot measure, if passed, would reform Costa-Hawkins and allow cities to expand rent control to newer buildings at least 15 years old, detached houses, and condos. Cities would also be allowed to implement vacancy control, limiting rent increases when a unit becomes vacant to 15% every 3 years. Homes owned by individuals who only own 1 or 2 homes would be exempt from the RAA.

I have a separate detailed summary of the Rental Affordability Act here.

SB-1157 Tenancy: credit reporting: lower income households. (Bradford)

This bill would require landlords of any housing that receives government assistance —such as low income housing subsidies, or a project that uses a density bonus or discounted public land — to offer tenants the option to have their rent payments reported to a national credit reporting agency. This can be used by tenants to build credit and get a lower cost mortgage in the future.

SB-1190 Tenancy: termination: victims of crime. (Durazo)

Would allow tenants to terminate a lease if they or an immediate family or household member are a victim of violent crime or are crime causing emotional injury and the threat of physical injury.

AB-2503 Senior citizen housing developments. (Blanca Rubio)

AB2503 would give residents of senior housing the right to have a roommate.

AB-2763 Housing: relocation assistance. (Bloom)

AB2763 gives tenants more protections when a regular apartment building is converted into an income-restricted affordable housing. Landlords would not be able to force existing tenants to move unless comparable replacement housing is provided. AB2763 would also consider raising rents by more than 5% to count as displacement.

AB-2774 Hiring of real property: tenants: late fees. (Jones-Sawyer)

Limits late fees for rent to $50.

AB-3077 Residential real property: tenancy: termination: withdrawal of accommodations. (Santiago)

Bans the use of the Ellis Act by a landlord who wants to “go out of business” and evict all tenants in a building to sell the building as a Tenancy in Common to homeowners.

AB-3352 Hiring of real property: tenant remedies. (Friedman)

If a landlord fails to maintain a home, current law allows tenants to fix it or hire someone to fix it, and then deduct the cost from rent, as long as 30 days notice is given, and the cost isn’t more than 1 month’s rent. AB3352 would reduce the required notice to 15 days and up the max cost to 2 months’ rent.

Vacant Homes

SB-1049 Local ordinances: short-term rentals. (Glazer)

Currently, the maximum fine a city can charge for illegal short-term rentals (airbnb’s and other rentals less than 30 days) is $1,000. SB-1049 would raise the limit to $5,000.

SB-1079 Residential property warehousing. (Skinner)

Allows cities to use eminent domain to buy corporate owned housing that has been vacant for more than 90 days, for use as affordable housing. Also would require a corporation that has owned housing that has been vacant for more than 90 days to offer the building first to community land trusts, tenant associations, and cities, prior to selling it on the open market. Cities would also be able to fine a corporation for leaving housing vacant for more than 90 days.

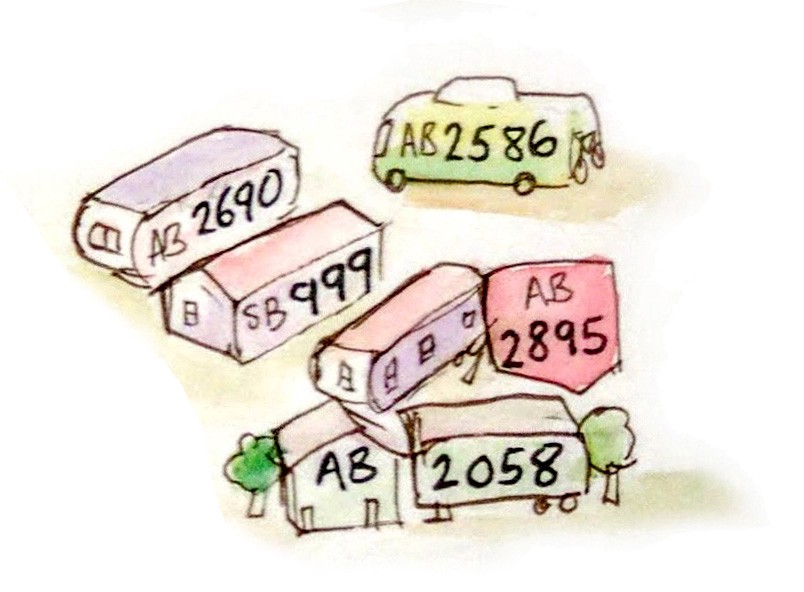

Mobile Homes

SB-999 Mobilehome park residencies: rent control: exemption. (Umberg)

Current state law exempts mobile home residents with leases of more than 12 months from being protected by local rent control laws. SB999 closes this loophole.

AB-2058 Income taxes: credits: low-income housing. (Gabriel and Friedman)

Creates a tax credit to make it easier for nonprofits to purchase mobile home parks and existing apartments to keep rents permanently low.

AB-2586 Shelter crisis: safe parking programs. (Berman)

Encourages cities to create Safe Parking Programs for people to live in their vehicles, by limiting liability and also allowing such programs to be operated as a temporary parking lot, instead of a permanent mobile home park.

AB-2690 Mobilehome parks: local ordinances: rent stabilization ordinances. (Low)

Would require all cities and counties to pass rent stabilization / rent control for mobile home parks by Jan 1, 2023, or justify why one isn’t necessary (for example, if city doesn’t have any mobile home parks).

AB-2895 Mobilehome parks: rent caps. (Quirk-Silva)

Would limit rent increases at mobile home parks to 5% plus inflation each year, with a hard cap of 10%. This is the same rent cap that was passed for regular housing in last year’s AB1482, which didn’t include mobile homes.

To summarize how SB999, AB2895,and AB2690 go together:

– SB999 allows cities to extend rent control to mobile homes.

– AB2690 requires cities to extend rent control to mobile homes by 1/1/2023.

– AB2895 provides a limited rent cap to all mobile homes statewide, even if a local law hasn’t been passed yet, and would take effect on 1/1/2021.

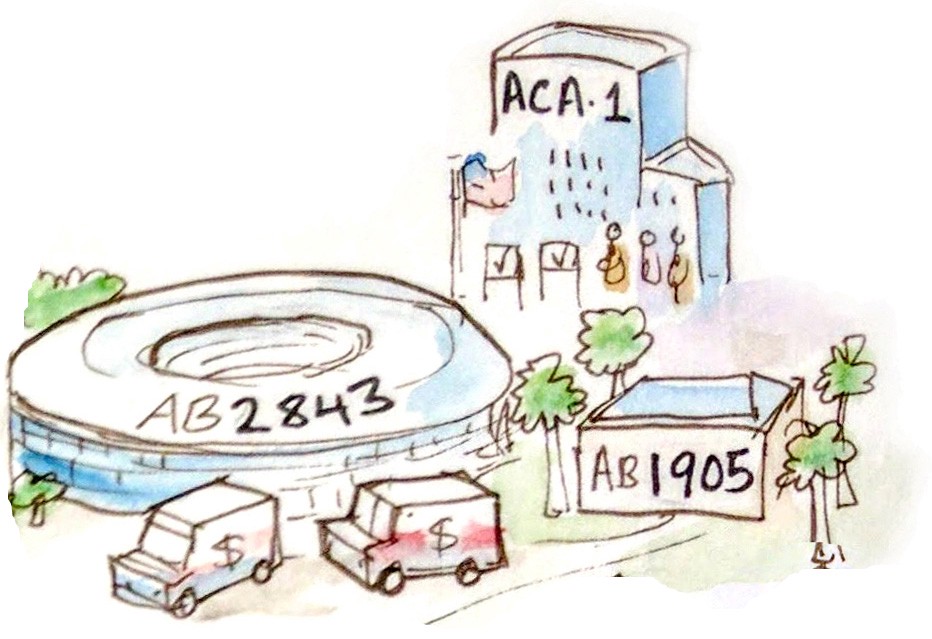

Funding sources

ACA-1 Local government financing: affordable housing and public infrastructure: voter approval. (Aguiar-Curry)

Currently, local ballot measures for taxes and bonds for affordable housing and infrastructure need to be passed by a 2/3 vote. ACA-1 would lower the threshold to 55%.

AB-1905 Housing and Homeless Response Fund: personal income taxation: mortgage interest deduction. (Chiu)

Currently, people who have a mortgage on a second home can get a tax deduction, reducing their state income tax. AB1905 would eliminate this tax break. It would also reduce the tax deduction for mortgages that are over $750,000 if they started on 1/1/2018 or later.

AB-2843 Local employer affordable housing fees: Affordable Housing Assistance Fund. (Chu)

A $75 per employee tax on large companies with over 200 employees, rising to $150 per employee for companies with 1000 or more employees.

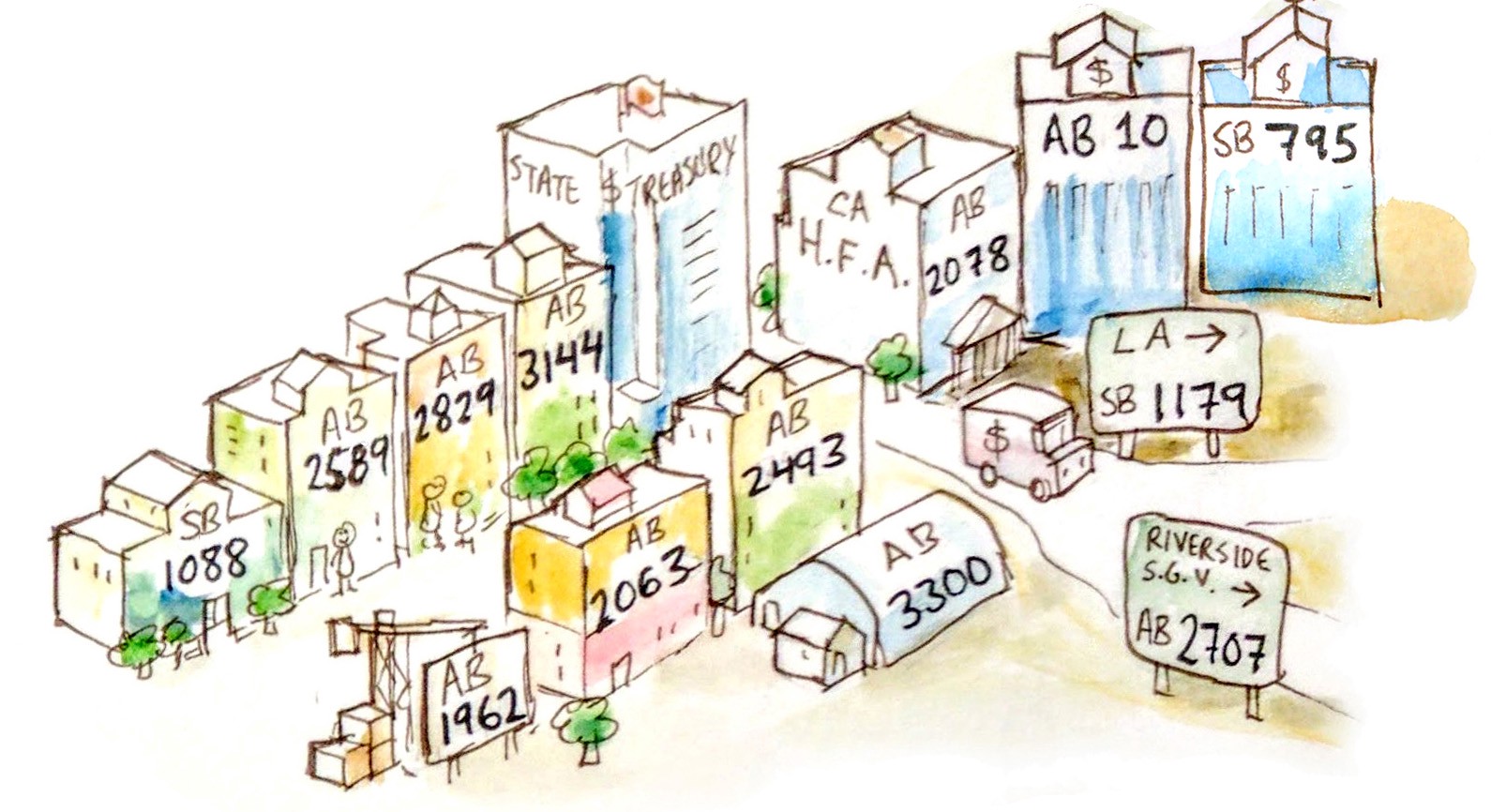

Funding Uses

AB 10 Income taxes: credits low-income housing: farmworker housing.

Expands Low Income Housing Tax Credit program by $500 million a year. LIHTC allows businesses to reduce their taxes by directly funding low income housing.

SB-795 Affordable Housing and Community Development Investment Program. (Beall, McGuire, and Portantino)

Before 2011, local Redevelopment Agencies were a major funding source for affordable housing. Budget shortages led to their elimination. SB795 would have created a new, similar program. The bill is similar to 2019’s SB5, which the legislature passed but the governor vetoed due to concerns about the cost.

SB-1088 Housing: domestic violence survivors. (Rubio)

Would set aside $10 million a year of state funding for housing for domestic violence survivors.

SB-1179 Property tax revenue allocations: County of Los Angeles: residential infill development. (Archuleta)

Many cities prefer commercial uses so they get more sales taxes. SB1179 would create a pilot program in southeast LA County: cities that build housing will get a bigger share from the pool of property taxes that are sent to the state government for redistributing to cities.

AB-1962 Sales and use taxes: exemption: senior housing. (Voepel)

Sales Tax Exemption for building materials purchased for building senior housing.

AB-2063 Property taxation: welfare exemption: low-income housing. (Mullin)

Currently, buildings where at least 90% of the apartments are low-income housing don’t have to pay property taxes. AB2063 would expand this exemption to cover buildings that are only 50% low-income apartments. It would also raise the total assessed value of property a nonprofit can have exempt from property tax from $20 million to $100 million.

AB-2078 Housing development. (Calderon)

Would allow the California Housing Finance Agency to directly make loans to developers, charging commercial rates for market-rate projects. Currently Cal HFA makes loans to first time homeowners and affordable housing.

AB-2493 Income tax credits: Homelessness Prevention Pilot Act of 2021. (Choi)

Creates a tax credit for people and businesses who lease apartments at below-market rates, to nonprofits for use as low income housing. Up to $500 per property and $2000 total per year.

AB-2589 No Place Like Home Program: permanent supportive housing. (Maienschein)

In 2018, voters passed Prop 2, which established the No Place Like Home Fund for reducing homelessness. AB2589 would allow more types of projects to be eligible for this funding, including licensed adult residential facilities, residential care facilities for the elderly, and other innovative housing solutions for mental health care.

AB-2707 Affordable housing: San Gabriel Valley: San Bernardino-Riverside metropolitan area. (Holden)

Placeholder bill for affordable housing funding in the San Gabriel Valley, San Bernardino, and Riverside area.

AB-2829 Property taxation: welfare exemption: rental housing: moderate-income housing. (Ting, Chiu)

Currently, if a building contains low income housing, its property tax bill is reduced relative to the percent of low income housing. AB2829 would also decrease property taxes relative to the percent of moderate income housing.

AB-3144 Housing Cost Reduction Incentive Program. (Grayson)

Local governments sometimes waive fees for affordable housing. AB3144 would give cities a bigger incentive to waive fees, by having the state cover half the cost.

AB-3300 Homelessness: grant funds. (Santiago, Bloom, Bonta, Gipson, Quirk-Silva, and Wicks)

$2 billion a year to help people out of homelessness and into permanent housing. Would include shelters, rental assistance, affordable housing, and vouchers.

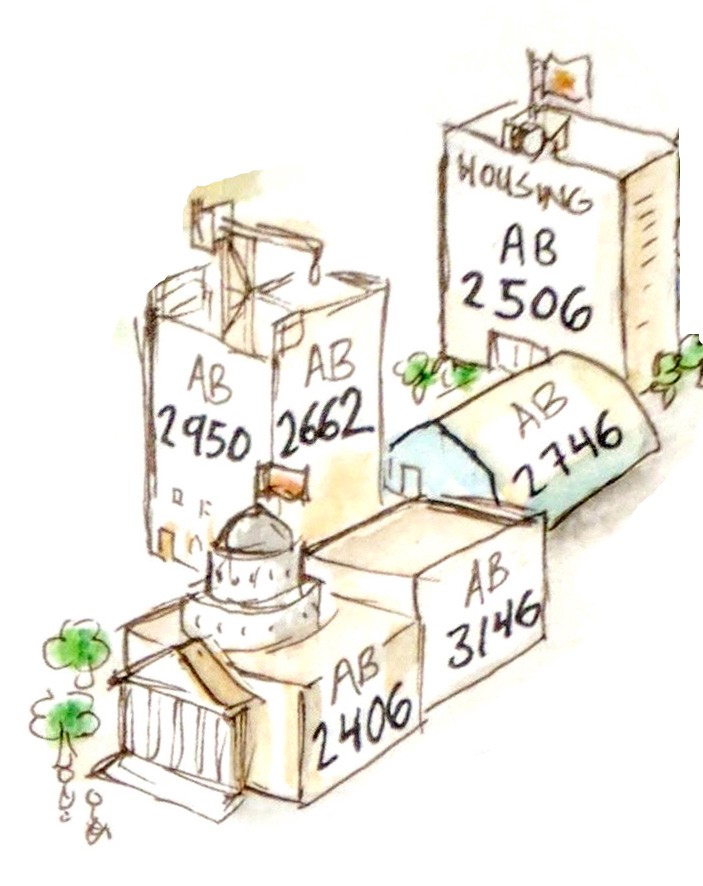

Data

AB-2406 Rental registry online portal. (Wicks)

In 2019, Assemblymember Wicks introduced AB724, a bill to create a statewide rental registry. Such a database keeps tracks of rents, and is useful to enforce rent caps and other tenant protections. While AB724 didn’t pass, a similar bill was introduced this year as AB2406.

AB-2506 State of California Housing Agency Act. (Irwin)

Right now, the state government has housing as part of the Business, Consumer Services, and Housing Agency. AB2506 would make it its own agency.

AB-2662 Affordable housing cost study (Blanca Rubio)

Would have the state do a study of recent affordable housing to determine how to reduce construction and other costs.

AB-2746 Homelessness. (Gabriel)

A bill to increase transparency and accountability on funding related to homelessness.

AB-2950 Affordable housing: alternative forms of development: model plan. (Weber)

Would have the state create a plan to reduce the per-unit cost of affordable housing, whether through new forms of construction such as modular, or cross-subsidized buildings with high, middle, and low income units.

AB-3146 Housing data: collection and reporting. (Bonta, Grayson)

Currently, cities only have to report the number of new homes built and permitted each year. AB3146 would require more data to be reported, as well as information on local laws around housing production and tenant protections.

Planning

AB-725 General plans: housing element: moderate-income and above moderate-income housing: suburban and metropolitan jurisdictions. (Wicks)

California cities are required to update zoning every 8 years to provide room for new housing. AB725 would require that at least 25% of the new zoned capacity be in areas that are already zoned for at least 2 but not more than 35 homes per acre. This helps reduce suburban sprawl.

PDF:

https://www.dropbox.com/s/wajz9381nllqpqm/CA-housing-bills-20200317.pdf?dl=0